Friends,

Every now and again, you see a simple chart, a list of numbers, that captures a far, far deeper story.

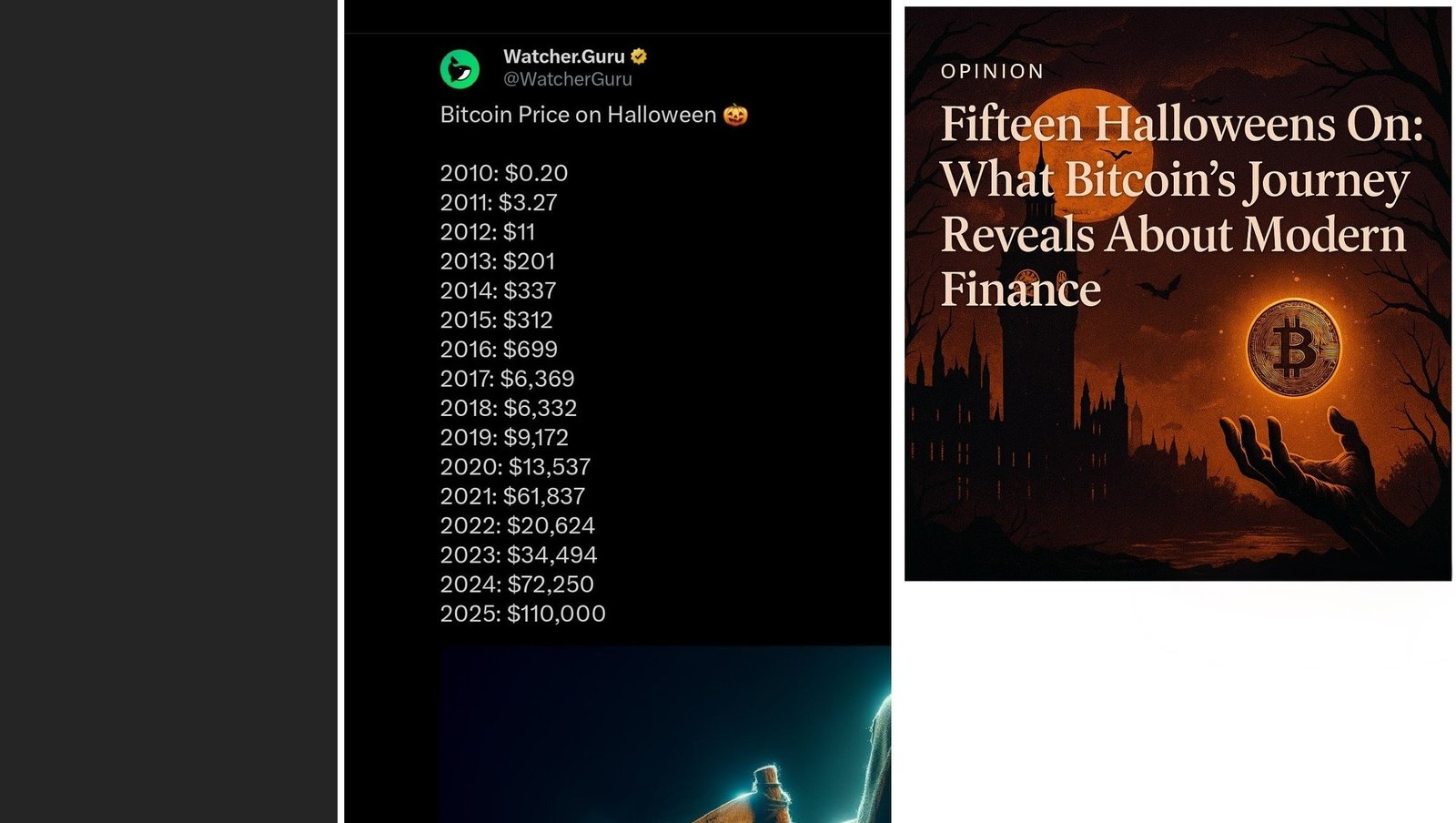

When Watcher.Guru published its list of Bitcoin’s price on Halloween, many saw it as just… trivia. Social-media chatter.

But I say to you, look more closely.

Look at that journey. From $0.20 fifteen years ago to around $110,000 today. Because in that journey, you see the chronicle of a remarkable, a profound, transformation. It is, in miniature, the story of how technology, how markets, and indeed how trust itself, have evolved in our modern age.

The March of Change

Now, this has not been a simple, straightforward path. Of course not. Great change is never easy.

From its earliest days, this technology has moved in distinct cycles. We’ve seen the surges of speculation, and yes, the painful corrections that follow. And yet, with every single cycle, something remarkable happens. The foundation gets stronger. The floor rises.

In 2012, $11. By 2016, $699. By 2020, $13,000. And today, after the inevitable fall, we find it at new heights, crossing that six-figure line.

This isn’t wild whimsy. It is not the whimsy of chance. It is the new economics. It is the mathematics of scarcity meeting the psychology of modern markets. A 550,000-fold increase, it’s almost unimaginable. But look that rate of growth is slowing. And this is not a sign of weakness. It is a sign of maturity.

From Protest to Participation

And this is the crucial point.

A decade ago, the language around this technology was the language of protest. Of rebellion. Of escaping the banks, of challenging central authority.

And where are we today?

Today, its largest holders are those very institutions. BlackRock. Fidelity. The great pension funds. Governments, once so dismissive, are now exploring this new world.

This isn’t a story of protest or participation. It is the story of protest becoming participation.

Because this is what happens. Real innovation always begins at the margins. It’s mistrusted. It’s misunderstood. But when it proves its resilience—when it survives the bubbles, withstands the bans, and endures the bear markets—it earns its place. It moves from the margins to the mainstream.

That is the journey Bitcoin has made.

A New Reality

And because it has grown up, it now responds to the world as it is.

The recent pullback, after the Trump-Xi trade meeting? That simply shows it is now part of the global conversation. It’s a reminder that no market escapes the laws of expectation. It now responds to global liquidity, to interest-rate policy, to confidence itself.

It is, in short, a serious part of the modern financial landscape.

So, it is fitting, I think, that we reflect on this today, on Halloween. The anniversary of that original whitepaper in 2008.

Fifteen Halloweens later, we have our proof. Proof that a powerful idea can, and will, outlast its doubters. Its journey from a piece of code to a cornerstone of this new world is not the story of a speculative myth.

It is the story of how openness, scarcity, and time can combine to reshape finance itself. And it is a future we must be ready for.