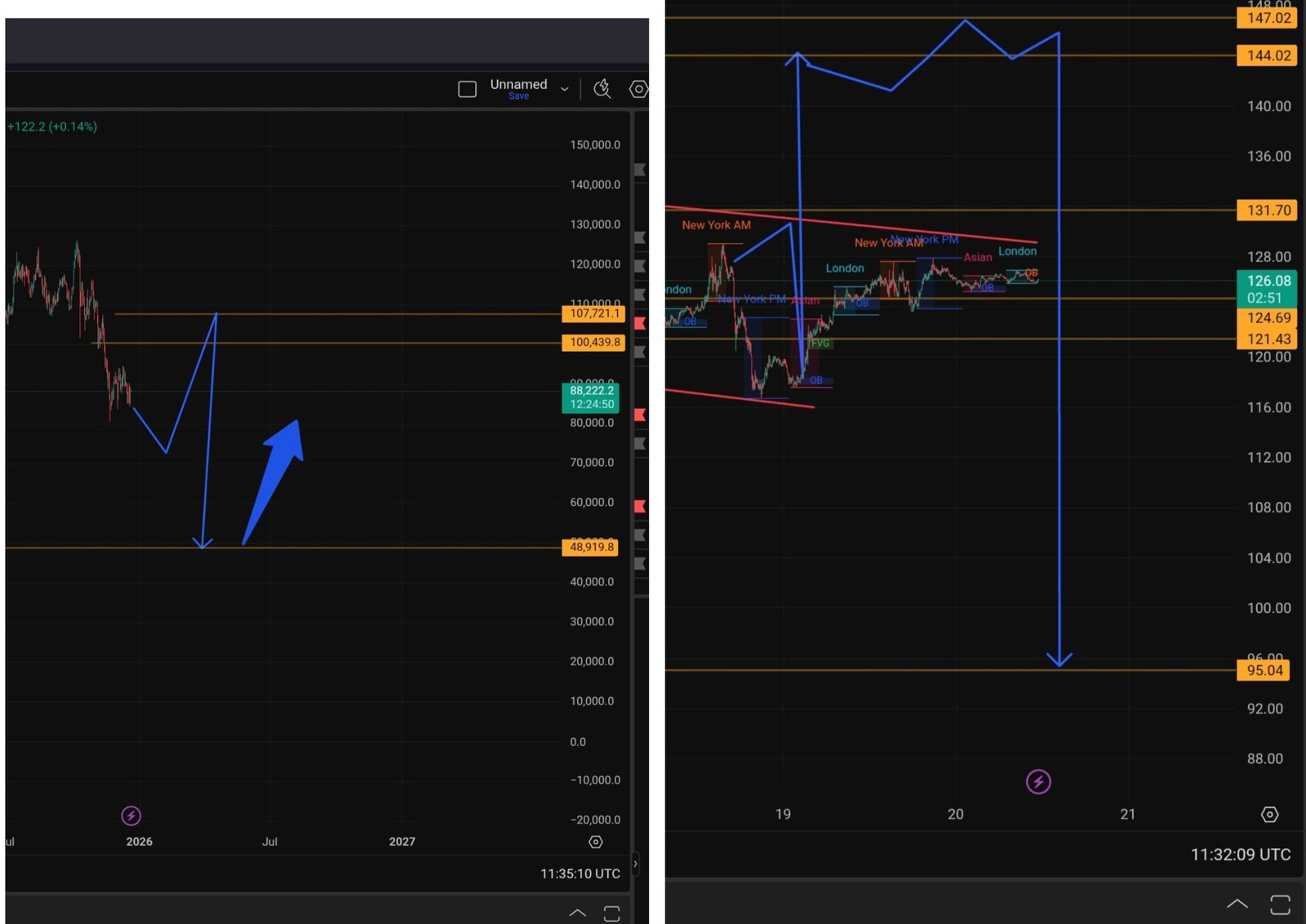

Despite recurring optimism in headlines and across social media, crypto markets continue to demonstrate that sellers dominate price action. At Cointiculate, our analysis points to Bitcoin testing 48,000 and Solana re‑evaluating toward 95, levels grounded not in fear but in the market’s structural dynamics and liquidity distribution.

Multiple events that would normally trigger rallies failed to push prices higher, signaling that bullish catalysts are currently ineffective. On December 19, softer-than-expected U.S. inflation data briefly lifted Bitcoin, yet the rebound quickly collapsed, confirming that buyers cannot sustain momentum. Similarly, recent commentary suggesting “bullish consolidation” for Bitcoin and a potential altcoin rally has yet to materialize, as prices continue sliding rather than breaking higher.

Institutional flows and asset-specific catalysts have also underperformed. XRP, despite strong institutional demand and ETF inflows, repeatedly failed to clear key resistance levels, demonstrating that long-term sellers are absorbing bullish pressure. Solana is experiencing the same pattern: positive ecosystem developments and fundamental strength have not translated into price support, reinforcing the thesis that upside remains capped and sellers are dictating market behavior.

Even seasonal patterns that historically favor crypto bulls have broken down. Q4, typically a period of strength, has seen price underperformance across Bitcoin and major altcoins, underscoring the structural dominance of sellers. Macro events, such as the Bitcoin Conference 2025, which included bullish endorsements and strategic commentary, had minimal impact on price, further confirming the market’s current bearish control.

This aligns with historical Cointiculate observations. Earlier this year, we correctly anticipated the largest liquidation phase, warning that your stop loss is often someone else’s take-profit. Today’s environment mirrors that setup: leverage is building faster than spot demand, cost-basis clusters sit well above current prices, and liquidity remains uneven. Market mechanics, not sentiment, will drive the next move.

Bitcoin’s 48,000 level is more than psychological. It coincides with prior high-volume nodes and structural support, a zone likely to absorb forced selling while cleansing speculative positions. Solana’s 95 level represents a prior accumulation base where long-term participants previously stepped in. These are logical destinations if sellers continue to control the market, with failed bullish events serving as confirmation.These are not end of cycle calls, nor are they emotional bearish takes. They are structural resets, the kind markets routinely require before clarity returns.

We called the last liquidation phase before it happened. The current setup suggests another reprice is approaching. Those who understand where liquidity sits will not be surprised by it. Those who do not will once again learn why markets rarely move in straight lines because Markets do not move to reward optimism; they move to punish imbalance. The repeated failure of bullish events is a clear signal: sellers are in charge, and any short-term rallies are likely to be absorbed. Positioning accordingly, with respect to these structural levels, aligns with the lessons proven in real-time by prior liquidations and ongoing market behavior.